Discover the Best Forex Trading Forum for Techniques, Information, and Networking

Discover the Best Forex Trading Forum for Techniques, Information, and Networking

Blog Article

The Relevance of Currency Exchange in Global Profession and Business

Money exchange functions as the foundation of international trade and business, making it possible for smooth deals in between diverse economic situations. Its influence expands past mere conversions, affecting rates strategies and revenue margins that are vital for businesses running globally. As variations in currency exchange rate can posture considerable threats, effective currency danger monitoring ends up being vital for keeping an one-upmanship. Recognizing these dynamics is essential, particularly in an increasingly interconnected marketplace where geopolitical uncertainties can further make complex the landscape. What are the implications of these variables on market access and lasting business strategies?

Role of Currency Exchange

Money exchange plays an important function in promoting worldwide profession by enabling transactions in between events running in various currencies. As businesses significantly participate in international markets, the need for efficient money exchange devices ends up being paramount. Exchange prices, which rise and fall based on different economic indications, identify the value of one money about one more, affecting trade dynamics substantially.

Additionally, currency exchange minimizes dangers related to international purchases by offering hedging options that secure versus unfavorable currency motions. This economic tool allows companies to maintain their expenses and earnings, better promoting global profession. In summary, the function of currency exchange is central to the functioning of worldwide commerce, providing the important framework for cross-border purchases and sustaining financial growth worldwide.

Effect On Pricing Approaches

The devices of currency exchange dramatically affect pricing strategies for companies participated in international trade. forex trading forum. Changes in currency exchange rate can bring about variations in expenses related to importing and exporting items, compelling companies to adjust their prices versions as necessary. When a domestic money enhances versus international money, imported items may come to be much less costly, enabling services to reduced costs or enhance market competition. Conversely, a weakened domestic currency can pump up import costs, triggering companies to reassess their prices to maintain revenue margins.

Moreover, businesses should think about the financial problems of their target markets. Neighborhood buying power, rising cost of living prices, and currency stability can dictate just how products are priced abroad. Companies often embrace prices techniques such as localization, where costs are tailored to each market based on currency variations and local economic elements. Additionally, dynamic prices versions might be utilized to react to real-time money movements, guaranteeing that organizations remain agile and affordable.

:max_bytes(150000):strip_icc()/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

Impact on Profit Margins

Rising and fall exchange prices can exceptionally affect revenue margins for services Find Out More participated in worldwide profession. When a company exports items, the earnings produced frequents a foreign currency. If the value of that currency reduces about the firm's home currency, the profits realized from sales can diminish dramatically. Alternatively, if the foreign currency appreciates, revenue margins can increase, enhancing the overall monetary performance of business.

Additionally, businesses importing goods face comparable threats. A decline in the worth of their home money can result in greater prices for foreign products, subsequently pressing earnings margins. This scenario demands effective currency danger management methods, such as hedging, to reduce prospective losses.

Firms should remain watchful in keeping track of money fads and readjusting their financial methods accordingly to protect their bottom line. In summary, understanding and managing the impact of currency exchange on profit margins is vital for businesses striving to maintain success in the complex landscape of global trade.

Market Gain Access To and Competitiveness

Navigating the complexities of international profession needs visit this website services not just to handle earnings margins yet also to guarantee effective market accessibility and enhance competition. Money exchange plays a crucial role in this context, as it straight affects a company's ability to enter new markets and complete on a global scale.

A positive currency exchange rate can lower the expense of exporting products, making items more appealing to foreign customers. On the other hand, an undesirable price can inflate rates, impeding market infiltration. Companies must strategically handle money variations to enhance rates techniques and remain competitive against local and worldwide players.

In addition, organizations that properly utilize money exchange can produce chances for diversification in markets with beneficial conditions. By establishing a solid presence in several money, organizations can minimize dangers connected with reliance on a solitary market. forex trading forum. This multi-currency method not only enhances competition yet also cultivates resilience in the face of economic shifts

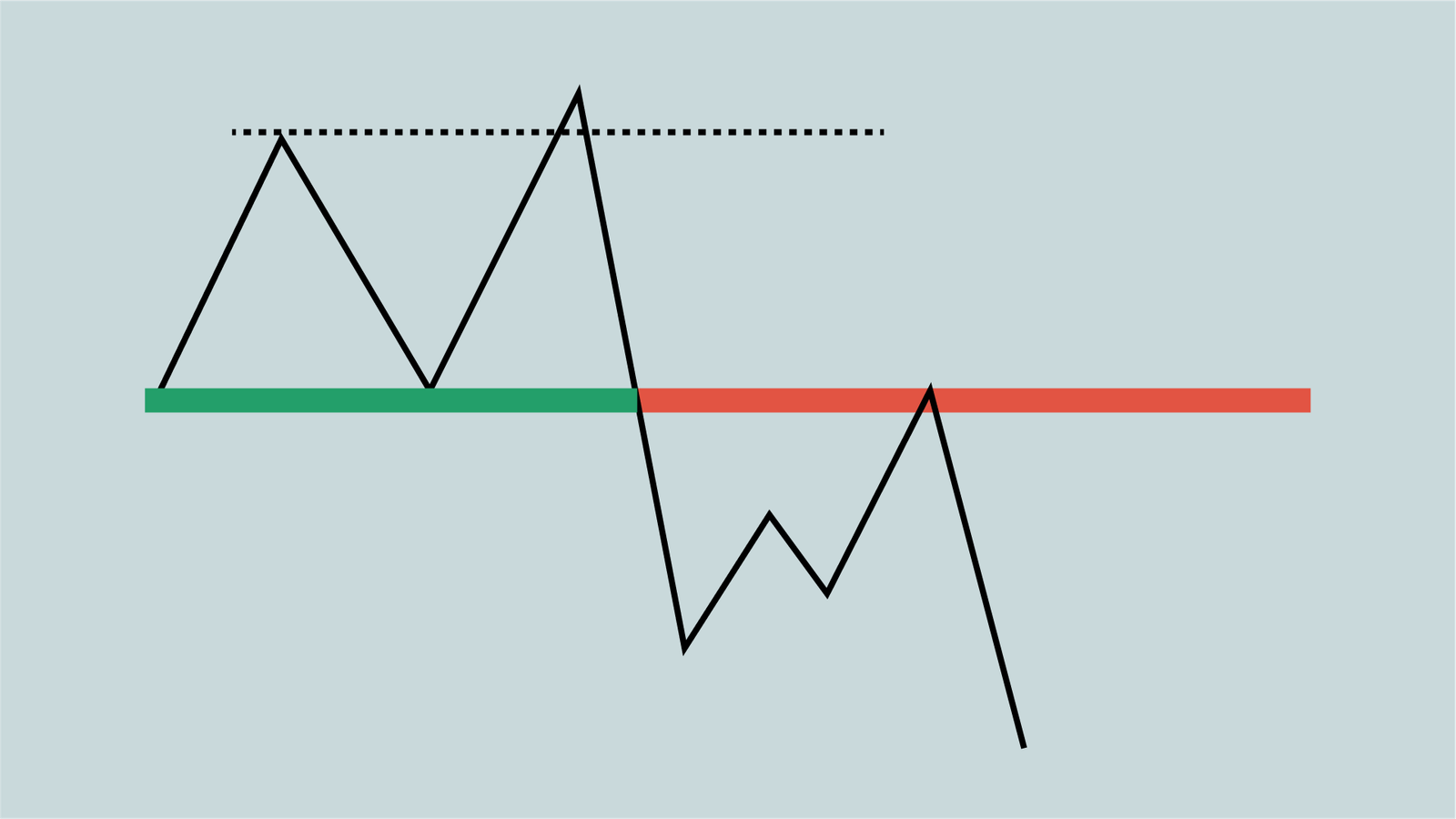

Dangers and Challenges in Exchange

In the realm of global trade, companies face considerable dangers and difficulties associated with money exchange that can influence their financial stability and operational techniques. One of the primary dangers is exchange rate volatility, which can cause unexpected losses when transforming currencies. Fluctuations in exchange rates can influence revenue margins, particularly for business participated in import and export activities.

Additionally, geopolitical factors, such as political instability and regulative adjustments, can exacerbate currency dangers. These aspects may result in abrupt shifts in currency worths, complicating monetary projecting and preparation. Companies must navigate the intricacies of international exchange markets, which can be affected by macroeconomic signs and market belief.

:max_bytes(150000):strip_icc()/chart-1905224_19201-92de2257433344a891781f064ceaf845.jpg)

Verdict

In conclusion, currency exchange offers as a foundation of worldwide profession and business, helping with transactions and boosting market liquidity. Regardless of intrinsic risks and difficulties linked with fluctuating exchange rates, the relevance of currency exchange in fostering economic growth and resilience remains undeniable.

Report this page